India 26QB-16B 2013-2024 free printable template

Show details

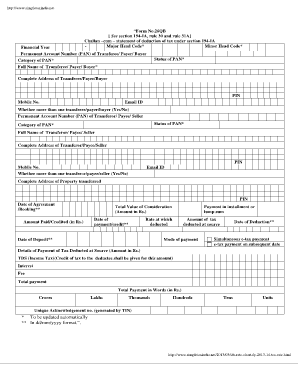

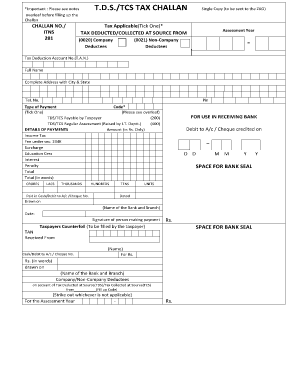

Generated by TIN To be updated automatically In dd/mm/yyyy format. FORM NO. 16B See rule 31 3A Certificate under section 203 of the Income-tax Act 1961 for tax deducted at source Certificate No. Last updated on Name and address of the Deductor Transferee/Payer/Buyer PAN of the Deductor Summary of Transaction s S. No. Number Date of payment/credit dd/mm/yyyy deposited in respect of the Total Rs. http //www. simpletaxindia*net Form No*26QB See section 194-IA rule 30 and rule 31A Challan cum...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 26qb download pdf form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 26qb download pdf form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 26qb download pdf online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 26qb form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out 26qb download pdf form

How to fill out 26qb form:

01

Gather all the necessary information, such as the buyer and seller details, property details, and transaction details.

02

Fill in the required fields accurately and provide any supporting documents, if required.

03

Double-check all the entered information to ensure its correctness and completeness.

04

Submit the filled-out form to the appropriate authorities within the specified timeline.

Who needs 26qb form:

01

Individuals or entities involved in the sale or transfer of immovable property in India.

02

Individuals or entities making payments for the purchase of immovable property.

Disclaimer: It's important to consult with a legal or taxation professional for specific guidance on filling out the 26qb form as it may vary based on individual circumstances and jurisdiction.

Fill form 26qb ddownload : Try Risk Free

What is form 26qb?

Form 26QB is a return-cum-challan form for the payment of Tax Deducted at Source (TDS) to the government for deductions made under Section 194-IA of the Income Tax Act, 1961. ... For instance, if the transaction occurred on 14th March then Form 26QB must be mandatorily submitted by 30th April.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 26qb form?

26QB is a form used to deposit TDS (Tax Deducted at Source) on sale of property in India. It is used to deposit TDS for the transfer of immovable property, such as land and buildings. It is submitted along with Form 26AS (Annual Tax Statement) to the Income Tax Department.

Who is required to file 26qb form?

26QB form is required to be filed by the seller of a property who has received a consideration (payment) of Rs. 50 lakh or more for the sale of the property.

How to fill out 26qb form?

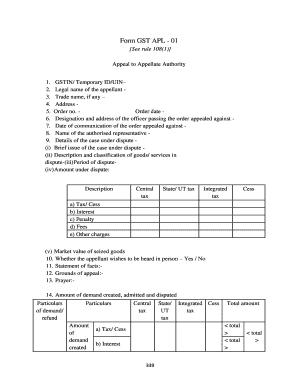

1. Begin by entering your GSTIN (Goods and Services Tax Identification Number) in the first box.

2. In the next box, enter the period to which the return relates.

3. Enter the total outwards taxable supplies (other than nil rated, exempt and non GST outward supplies) made during the taxable period in the box provided.

4. Enter the value of the inward supplies on which tax is payable by the recipient in the box provided.

5. Enter the total amount of ITC (Input Tax Credit) availed during the taxable period in the box provided.

6. Enter the amount of tax payable for the taxable period in the box provided.

7. Enter the amount of tax paid during the taxable period in the box provided.

8. Enter the amount of tax to be carried forward to the next period in the box provided.

9. Enter the amount of demand or refund due in the box provided.

10. Finally, sign and date the form at the bottom.

What information must be reported on 26qb form?

The 26qb form is used to report income tax withheld from non-salaried payments. It requires the reporting of the following information:

1. Payor name and address

2. Recipient name and address

3. Taxpayer Identification Number (TIN)

4. Amount of payment

5. Amount of taxes withheld

6. Date of payment

7. Nature of payment

8. Type of TIN

9. State where taxes are being deposited

10. Bank account details

When is the deadline to file 26qb form in 2023?

The deadline to file Form 26QB for the financial year 2023-24 is 31st July 2024.

What is the penalty for the late filing of 26qb form?

The penalty for late filing of 26QB is a late payment fee of 0.5% of the total amount of tax due, per month up to a maximum of 25%.

How can I get 26qb download pdf?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 26qb form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete 26qb form download on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form 26qb pdf from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I fill out 26qb form online on an Android device?

On Android, use the pdfFiller mobile app to finish your form 26qb download in pdf. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your 26qb download pdf form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

26qb Form Download is not the form you're looking for?Search for another form here.

Keywords relevant to download 26qb form

Related to 26qb form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.